Saving money on a new heating or cooling system has never been easier for Virginia homeowners. If you’re planning to change your old HVAC system this year, you can get money back through rebates and tax credits.

Right now, you can save thousands of dollars. The government wants to help people buy energy-efficient equipment, so they’re giving money to homeowners who make smart choices.

What Are HVAC Rebates and Why Do They Matter?

Think of HVAC rebates like coupons, but much better. When you buy a new heating or air conditioning system, you can get some of your money back. These savings programs help Virginia families afford better equipment that uses less energy.

Many people pay too much to heat and cool their homes because their old systems waste energy. When you get a new system with a rebate, you save money twice: first when you buy it, and then every month on your electric bill.

Understanding the Difference Between Rebates and Tax Credits

These two work differently, and you need to know the difference.

Rebates give you money back fast. After you buy your new HVAC system, you fill out some papers. Then you wait a few weeks or months, and you get a check in the mail. Some rebates happen right away at the store when you buy the equipment.

Tax credits work during tax time. Let’s say you owe $2,000 in taxes. If you get a $600 tax credit for your new furnace, you only pay $1,400 instead. You have to wait until you file your taxes to get this money back.

I once helped my neighbor understand this. She thought rebates and tax credits were the same thing. When she learned the difference, she planned better and saved over $3,000 on her new heat pump.

How Much Money Can You Save with Virginia HVAC Rebates?

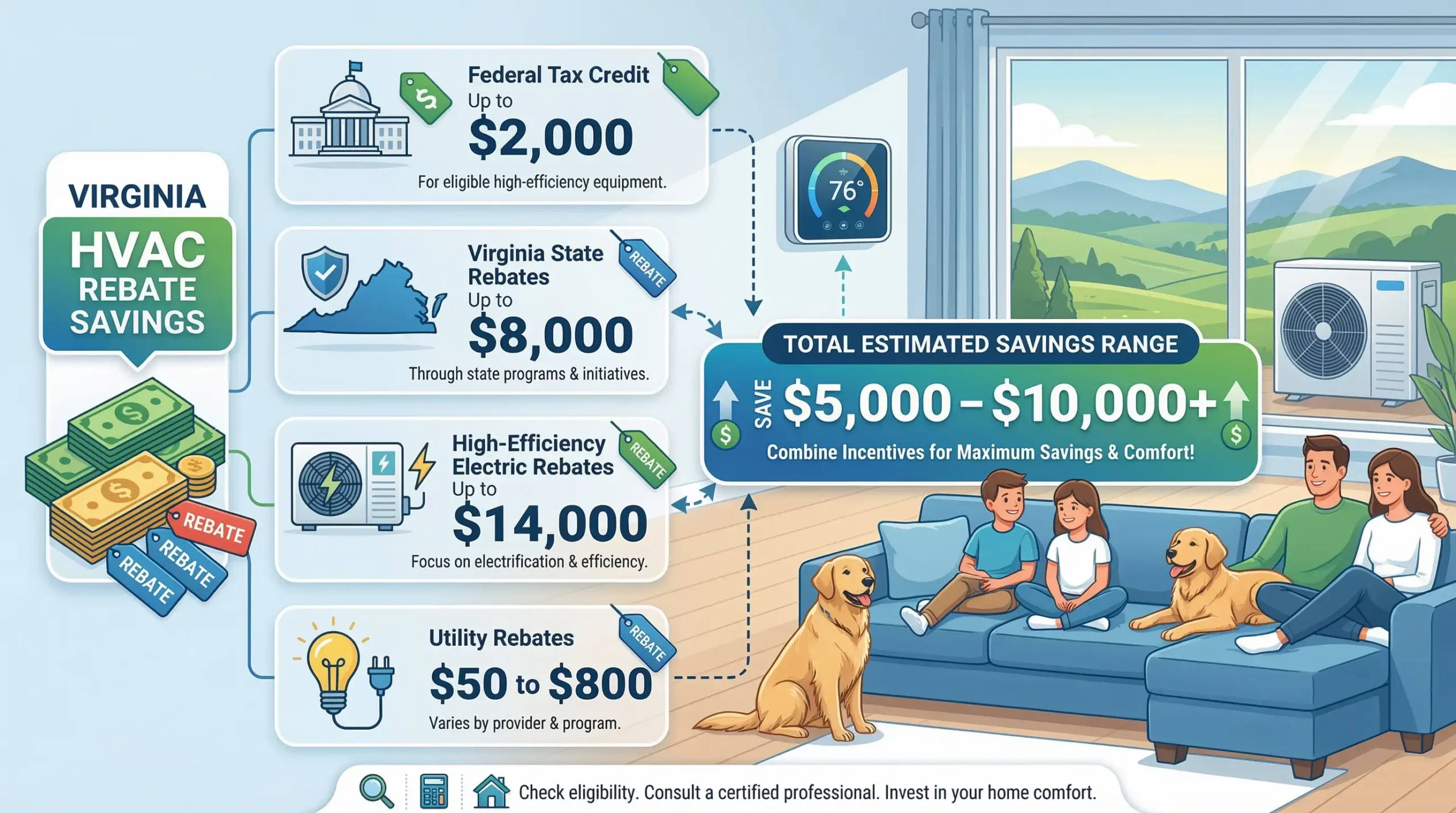

The savings can be huge. Here’s what you might save:

- Federal tax credits can give you up to $2,000 for a heat pump or $600 for other equipment like furnaces and air conditioners. The government covers 30% of what you spend, including installation costs.

- State rebates in Virginia will offer up to $8,000 for some families through the Home Efficiency Rebate program. The High Efficiency and Appliance Rebate program adds another $14,000 maximum for buying electric equipment.

- Utility companies like Dominion Energy and Washington Gas give extra rebates. These range from $50 for a smart thermostat to $800 for high-quality furnaces and boilers.

When you add everything together, a family could save $5,000 to $10,000 or more. That’s real money that stays in your pocket.

Federal HVAC Tax Credits Available in Virginia 2026

The federal government created new programs to help homeowners save money and protect the environment. These programs give you money back when you buy equipment that uses energy wisely.

Inflation Reduction Act Benefits for Homeowners

In 2022, the government passed a law called the Inflation Reduction Act. This law created some of the best savings programs ever for people who want to change their HVAC systems.

Before this law, tax credits were small and hard to get. Now, the rules are much better. You can save more money, and more types of equipment qualify.

According to the U.S. Department of Energy, these programs will help millions of American families save money on their energy bills while making their homes more comfortable.

The law covers costs through December 31, 2026. If you’re thinking about buying new equipment, don’t wait too long. You need to finish the work before the end of 2026 to claim these credits on your 2026 tax return.

Which HVAC Systems Qualify for Federal Tax Credits?

Not every system gets you money back. You need to buy equipment that meets certain rules.

Heat pumps are the best deal. You can get 30% of your total cost back, up to $2,000. This includes both the equipment and the work to install it. Heat pumps are special because they both heat and cool your home. In Virginia’s weather, they work great.

Air conditioners must have at least a 16 SEER2 rating to qualify. You can get back 30% of the cost, but only up to $600. SEER2 is a number that shows how well the system works. Higher numbers mean better efficiency.

Furnaces need to be really efficient. Gas or oil furnaces must have at least 97% AFUE to qualify. You get 30% back, up to $600. AFUE shows what part of the fuel turns into heat for your home.

Boilers have similar rules. They need 95% AFUE or higher. You also get 30% back, up to $600.

Ductless mini-splits are becoming popular in Virginia. They must have at least 16 SEER2, 12 EER2, or 9 HSPF2 ratings. You can get up to $2,000 back.

Here’s something important: these are tax credits, not refunds. They lower the taxes you owe. If you don’t owe enough taxes, you might not get the full amount back. Talk to a tax person if you’re not sure.

Virginia State Home Energy Rebate Programs

Virginia is working on two big rebate programs that will help even more families. These programs use money from the federal government, but Virginia decides how to run them.

Home Efficiency Rebate Program Details

This program gives money to homeowners who make their homes use less energy. You can get up to $8,000 back, but you have to save at least 15% on your energy use.

Here’s how it works: A trained person comes to your house and checks how much energy you use. Then you make changes like adding insulation, fixing air leaks, or getting a new HVAC system. After the work is done, they check again. If you saved 15% or more energy, you get the rebate.

The program works for both small and large projects. You could change just your heating system, or you could fix many things at once. Bigger changes often get you more money back.

Virginia Energy is still setting up this program. According to their website, the state is waiting for final approval from the federal government to start giving out rebates (https://www.energy.virginia.gov/energy-efficiency/HomeEnergyRebatesFrequentlyAskedQuestions.shtml). They hope to begin soon, but they can’t promise an exact date yet.

High Efficiency and Appliance Rebate Program

This program is different. It gives you money for buying specific types of electric equipment. You can get up to $14,000 per house.

The program covers:

- Heat pump for space heating and cooling: up to $8,000

- Heat pump water heater: up to $1,750

- Electric stove, cooktop, or range: up to $840

- Heat pump clothes dryer: up to $840

- Electrical load service center upgrade: up to $4,000

- Insulation, air sealing, and ventilation: up to $1,600

- Electric wiring: up to $2,500

Not everyone qualifies for the full amounts. Your household income matters. Families who make less money can get larger rebates. The program uses something called area median income to decide who gets what.

One great thing about this program: you get the rebate when you buy the equipment. You don’t have to wait or send in papers later. The store takes money off the price right away.

Virginia got $188 million total for these two programs. That’s enough to help many thousands of families.

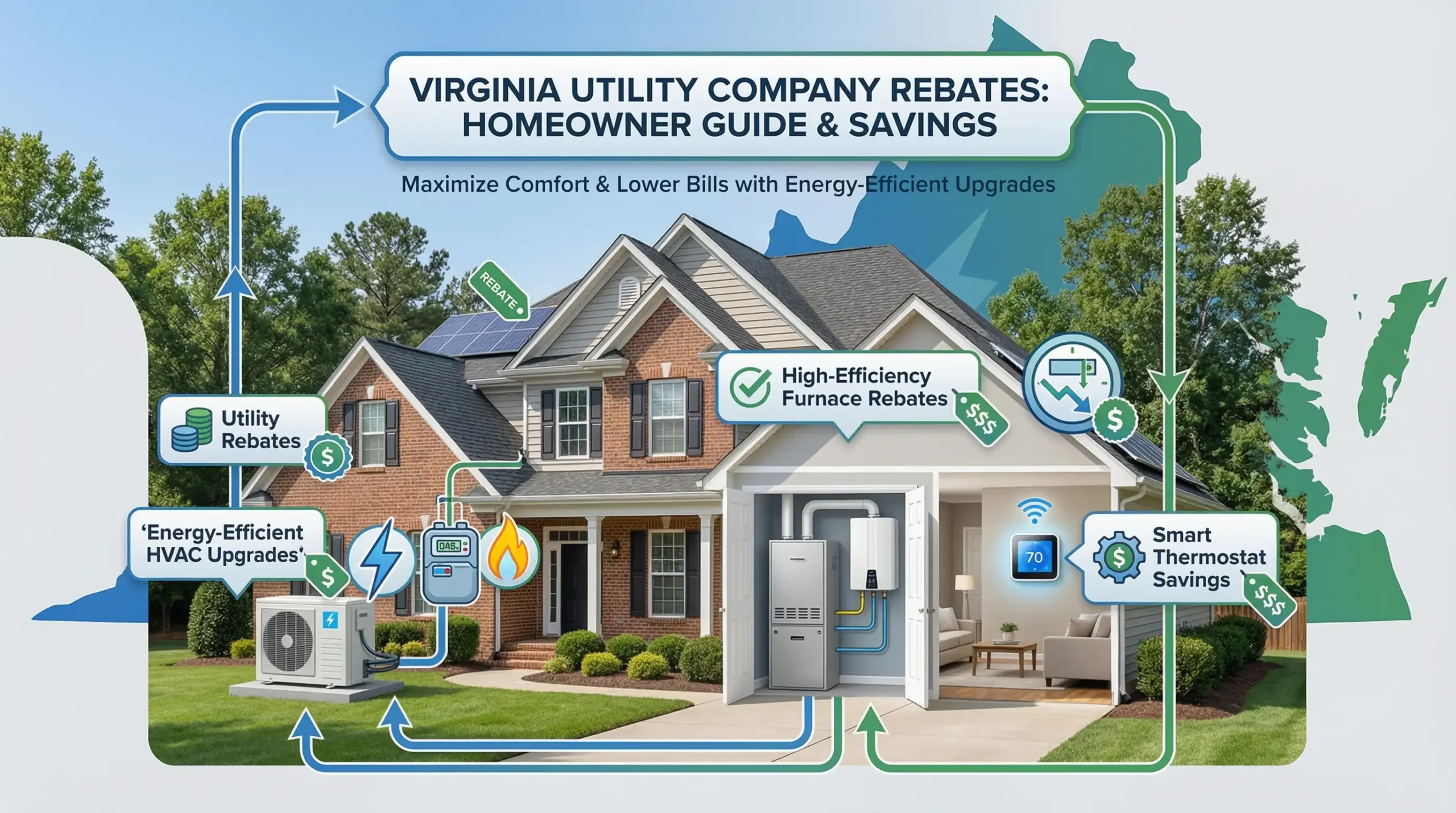

Utility Company Rebates for Virginia Residents

Your local utility company probably offers rebates, too. These add to the federal and state programs, giving you even more savings.

Dominion Energy Virginia HVAC Rebates

Dominion Energy serves most of Virginia. They run many different rebate programs for homes and businesses.

For homeowners, they offer a Home Energy Assessment Program. A trained person visits your house and suggests ways to save energy. After you make the changes, you can get rebates on things like ductwork repairs, HVAC tune-ups, and new equipment.

They also have special programs for people with low incomes or people over 60 years old. These programs give free energy checks and install energy-saving products at no cost.

The company offers rebates on small items, too. You can get money back on smart thermostats, air purifiers, bathroom fans, and more. Many of these have instant rebates at certain stores.

One program I really like is their Appliance Recycling program. If you have an old refrigerator or freezer, they’ll pick it up and give you $20. Getting rid of old appliances that waste energy helps everyone.

Some programs have waiting lists because many people want to join. For 2026, Dominion Energy says participation is “available on a limited basis” for some programs. Call them early if you’re interested.

Washington Gas and Virginia Natural Gas Offers

Washington Gas serves Northern Virginia and parts of the Shenandoah Valley. They have great rebates for people who use natural gas for heating.

Their biggest rebates go to high-efficiency furnaces and boilers. You can get $500 to $800 back, depending on how efficient your new equipment is. They also give $100 rebates for tune-ups on your heating system.

Right now, they have a special program for dual-fuel heat pumps. These systems use both electricity and natural gas. You can get $2,000 to $2,600 back on these systems. That’s a huge savings.

Washington Gas also offers $100 back on ENERGY STAR smart thermostats. These thermostats learn your schedule and can save you money every month.

Virginia Natural Gas serves the Hampton Roads and Virginia Beach area. Their programs are similar. They give rebates on:

- High-efficiency tankless water heaters: $150 to $300

- High-efficiency furnaces: $300 to $500

- Tank-style water heaters: $75 to $150

- Wi-Fi smart thermostats: $50

All equipment must be installed by a licensed contractor. The contractor usually helps you fill out the rebate application. Make sure you keep all your receipts and papers.

Appalachian Power serves western and southern Virginia. They have programs for homes and businesses, including a Home Performance Program that combines energy checks with rebates.

Who Qualifies for HVAC Rebates in Virginia?

Not every person or home qualifies for every program. Understanding the rules helps you know what you can get.

Income Requirements and Eligibility Rules

Federal tax credits have no income limits. Anyone who owes federal taxes and buys qualifying equipment can claim them. You just need to file your taxes and have the right paperwork.

State rebate programs are different. The High Efficiency and Appliance Rebate program only helps families who make less than 150% of their area’s median income. This means if the typical family in your area makes $60,000 per year, you need to make less than $90,000 to qualify.

The Home Efficiency Rebate program has no income limits. Anyone can apply. But families with lower incomes might get more money back.

Utility company programs usually don’t have income limits either. You just need to be a customer of that utility. Some companies check if you’re responsible for paying the electric or gas bill.

Dominion Energy has special programs for people over 60 or families with very low incomes. These programs offer extra help. You might get free energy checks, free weatherization work, and help paying your bills.

To prove your income, you might need to show tax returns or pay stubs. Each program has its own rules about what documents they want.

Property Types That Qualify for Rebates

Most rebate programs work for single-family homes. This includes regular houses and townhouses where one family lives.

Multifamily dwellings like apartment buildings can qualify too. Both building owners and renters might be able to get rebates, but they usually need permission from the landlord.

Manufactured homes and mobile homes qualify for most programs. These homes often need better heating and cooling systems, so the rebates really help.

One thing that’s really important: most programs only work for existing homes. If you’re building a brand new house, you probably can’t get these rebates. New construction has different rules and sometimes different programs.

Renters can apply for rebates if they get written permission from their landlord. The household income calculation is based on the renter’s income, not the landlord’s.

Commercial properties don’t qualify for these residential programs. But businesses have their own rebate programs with different rules.

How to Apply for HVAC Rebates in Virginia

Getting your rebates is easier than you might think. Follow these steps and you won’t miss out on money.

Step-by-Step Application Process

First, decide what equipment you want to buy. Check which programs you qualify for. Look at federal, state, and utility rebates. Make a list of everything you might get back.

Second, find a licensed contractor who knows about rebates. Many contractors work with rebate programs all the time. They can help you pick equipment that qualifies and fill out the papers. Some rebates require the contractor to apply for you.

Third, don’t buy anything or start work until you understand all the rules. Some programs need pre-approval before you start. Others let you apply after the work is done. Getting this wrong could cost you thousands of dollars.

Fourth, make sure your contractor installs ENERGY STAR certified equipment that meets all the program requirements. Get copies of all papers that show what you bought and that it was installed correctly.

Fifth, submit your applications. For federal tax credits, you file IRS Form 5695 with your tax return. For state and utility rebates, each program has its own application form. Most can be filled out online now.

Sixth, keep copies of everything. Save your receipts, applications, and any letters you get. You might need them later, especially for your taxes.

Required Documents and Contractor Information

You’ll need several things to apply:

Proof of purchase: This means receipts or invoices showing what you bought, when you bought it, and how much you paid. Make sure the equipment model numbers are on the receipt.

Contractor information: You need the name, license number, and contact information for the contractor who did the work. They might need to sign forms saying they installed everything correctly.

Equipment specifications: This includes model numbers and efficiency ratings. The contractor usually provides this. It proves your equipment meets the program requirements.

Before and after energy audits: Some programs require a professional to check your home’s energy use before and after you make changes.

Proof of address: You need to show you live at the address where the work was done.

Income documentation: For income-based programs, you might need recent tax returns or pay stubs.

My friend learned this lesson the hard way. He replaced his furnace but threw away the receipt before applying for rebates. He had to ask the contractor for a new copy, and it delayed his rebate by two months.

Start a folder for all your HVAC papers. Put everything related to your project in one place. This makes applications much easier.

Best HVAC Systems to Maximize Your Rebates

Some types of equipment get you more money back than others. Choosing wisely can save you thousands of extra dollars.

Heat Pumps: The Biggest Money Savers

Heat pumps are the winners when it comes to rebates. They qualify for almost every program, and the amounts are the highest.

A good air-source heat pump can get you $2,000 from the federal tax credit, up to $8,000 from the state appliance rebate, and $50 to $1,625 from utility rebates. That’s over $10,000 in total possible savings.

Heat pumps work great in Virginia’s climate. They both heat and cool your home. In summer, they work like air conditioners. In winter, they pull heat from outside air and bring it inside. Yes, there’s heat in cold air – heat pumps are smart enough to find it.

Modern heat pumps work well even when it’s very cold. The newest cold-climate models keep your home warm even when it’s below freezing outside.

Geothermal heat pumps cost more to install, but they save even more money over time. They use the ground’s stable temperature instead of outside air. Federal tax credits cover 30% of the cost with no dollar limit for geothermal.

When you shop for a heat pump, look for high SEER2 and HSPF2 ratings. Higher numbers mean better efficiency. Better efficiency means lower electric bills every month.

I installed a heat pump last year. My electric bill dropped by almost $100 per month in winter. The rebates covered half the cost of installation. Within three years, the system will have paid for itself completely.

Other High-Efficiency Equipment Worth Considering

Don’t forget about other equipment that qualifies for rebates.

Smart thermostats are cheap but save money every month. They cost $100 to $300, but rebates often cover half the price. These thermostats learn when you’re home and when you’re away. They adjust the temperature automatically to save energy.

High-efficiency furnaces with 97% AFUE or higher qualify for federal tax credits. If you use natural gas or oil for heating, this is a smart choice. The furnace uses almost all the fuel to heat your home instead of wasting it.

Tankless water heaters are another option. They heat water only when you need it, saving energy. Some utility companies offer rebates on these units.

Ductless mini-splits work great for additions or homes without ductwork. They’re very efficient and qualify for up to $2,000 in federal tax credits.

Insulation and air sealing might not seem exciting, but they make a huge difference. State rebates cover up to $1,600 for this work. When your home holds heat better, your HVAC system doesn’t work as hard.

Think about your whole home, not just your heating and cooling equipment. The best savings come when you combine several upgrades together.

Common Mistakes to Avoid When Claiming Rebates

People lose money on rebates by making simple mistakes. Don’t be one of them.

Timing Your Purchase Correctly

This is the biggest mistake I see. People buy equipment without checking if rebates are available or if programs have changed.

Federal tax credits are good through December 31, 2026. If you complete your installation in December 2026, you can claim the credit on your 2025 taxes that you file in 2026. But if you wait until January 2026, the rules might be different.

State rebate programs aren’t available yet. Virginia Energy says they’re working on it, but no one knows exactly when they’ll start. If you need new equipment right away, don’t wait. Use federal and utility rebates now. But if you can wait a few months, the state programs might give you more money.

Some utility rebates have limited funding. Dominion Energy already says some 2026 programs are “on a limited basis.” First come, first served. Apply early in the year before money runs out.

Here’s another timing issue: most rebates aren’t retroactive. This means you can’t get money back for equipment you installed before the program started. Check the exact start dates for each program.

Working with Licensed Contractors Only

Every rebate program requires work to be done by a licensed contractor. If your neighbor’s friend installs your heat pump to save money, you won’t qualify for any rebates.

Make sure your contractor:

- Has a valid license in Virginia

- Has experience with rebate programs

- Can provide all required documentation

- Will help you with applications

Some utility companies have lists of participating contractors who know their programs well. Using these contractors can make everything easier.

Get written estimates before work starts. Make sure the estimate includes:

- Equipment model numbers and specifications

- Total cost including installation

- Which rebates you qualify for

- Who will handle rebate applications

Don’t make final payment until all work is complete and inspected. You need to prove the work was done correctly to get your rebates.

Watch out for contractors who promise unrealistic rebate amounts. If something sounds too good to be true, it probably is. Check the official program websites to verify what you can actually get.

Some homeowners try to do the work themselves to save money. This is a big mistake. Not only do you lose all rebates, but you might install the equipment wrong. HVAC systems are complicated. Let professionals do the work.

Conclusion

Virginia homeowners have more chances than ever to save money on HVAC systems in 2026. Between federal tax credits, upcoming state rebates, and utility company programs, you could save thousands of dollars on a new heating or cooling system.

The key is to plan ahead. Learn which programs you qualify for, find a good licensed contractor, and get all your papers in order. Don’t wait until the last minute, because some programs have limited funding.

Heat pumps offer the biggest savings, but other equipment qualifies too. Think about what your home needs and what fits your budget after rebates.

Start by checking your current system. If it’s more than 10 or 15 years old, it’s probably time to change. Newer systems work much better and cost less to run. With all these rebates available, now is the perfect time to make the switch.

Remember, these programs won’t last forever. Federal tax credits end in December 2025, and state programs have limited funding. The sooner you start, the more money you can save.

For further details, visit us and get professional help.

Frequently Asked Questions

When will Virginia’s state HVAC rebates be available?

Virginia Energy is still waiting for final approval from the federal government to start the Home Efficiency Rebate and High Efficiency and Appliance Rebate programs. They can’t give an exact date yet. Recent federal policy changes might affect the timeline. Check the Virginia Energy website regularly for updates, or sign up for email alerts. Until state programs start, you can still use federal tax credits and utility rebates.

Can I combine federal and state rebates for the same system?

Yes, but with limits. You can use federal tax credits and state rebates together, but you can’t use two state rebates for the same piece of equipment. For example, you can get a federal tax credit and a Home Efficiency Rebate for your heat pump, but you can’t also use the High Efficiency and Appliance Rebate for that same heat pump. You could use one for your heat pump and another for your water heater. Utility rebates can usually stack with everything.

Do renters qualify for HVAC rebates in Virginia?

Yes, renters can qualify, but they need written permission from their landlord. The landlord has to agree to let you make changes to the heating or cooling system. For income-based programs, they use the renter’s income, not the landlord’s. This makes sense because the renter pays the electric bill and benefits from lower costs. Talk to your landlord early to get permission before you start any work.

Are rebates available for commercial properties?

The programs we discussed here are only for homes, not businesses. But commercial properties have their own rebate programs with different rules. Dominion Energy, Appalachian Power, and other utilities offer business rebate programs. These often cover offices, stores, restaurants, and factories. Federal tax rules for commercial buildings are also different. If you own a business, check with your utility company about commercial programs.

What happens if I installed my HVAC system before the rebate program started?

Unfortunately, most rebates aren’t retroactive. This means you can’t get money back for work you already did before the program began. The Home Efficiency Rebate might have some exceptions, but rules aren’t final yet. Federal tax credits only work for equipment installed during the year you’re claiming the credit. If you’re thinking about new equipment, wait until programs are active before you buy. Check exact start dates for each program to avoid missing out.